Figuring depreciation on equipment

Plant and equipment depreciation Division 40 - covering the value of removable items Australian law allows investors to claim tax deductions on both the decline in value of the buildings structure and items considered permanently fixed to the property and the decline in value of plant and equipment assets found within it think ovens. Coverdell Education Savings Account ESA formerly known as Education ED IRA.

Manufacturing Equipment Depreciation Calculation Depreciation Guru

This refers to fixed assets bought by a company that depreciate in value over time.

. Burke Teichert Mar 05 2020 Recently I have read several articles about depreciation of cows or in a cow herd. Figuring depreciation on a fixed asset like equipment is easy. Capital Cost Allowance - CCA.

They become familiar with manufacturing and employment costs discounts maintenance costs. They begin with the mathematical aspects of personal business and move into banking real estate vehicles and insurance. Figuring depreciation on your cows can be a challenge.

If you use the cash method for figuring your income you must use the cash method for reporting your expenses. In other words Section 179 gives you the ability to take all of your deduction in one year whereas the bonus depreciation allows you to deduct the full cost of the vehicles in one year. Course Overview In the Acellus Business Math course students gain knowledge of the specific applications of mathematics in the business world.

Assets that depreciate include warehouse equipment and machinery furniture computer equipment delivery vehicles buildings and store displays. A capital cost allowance CCA is a yearly deduction or depreciation that can be claimed for income tax purposes on the cost of certain assets. We need to know how a property or building depreciates and the expected life span of a building before it declines.

Main points and limitations. The interest rate i which we use to calculate present value is. Your original basis is usually the purchase price.

Real property is subject to changes due to depreciative factors that affect a propertys purchase price. Whats not good about depreciation is the fact that it opposes the idea of having your real estate a chance to have the right price. If you have an IRA basis and were a nonresident in prior years you may need to restate your California IRA basis.

Year 5 works a little differently. In comparison equipment which generally qualifies for full expensing treatment under the 100 percent bonus depreciation provision of the TCJA makes up just 15 percent of the private capital stock. 1005 for more information and worksheets for figuring the adjustment to enter on line 4 if any.

The term capital cost. However if you acquire property in some other way such as inheriting it getting it as a gift or building it yourself you have to figure your original basis in a different. The basis used for figuring depreciation is the same as the basis that would be used for figuring the gain on a sale.

If you take a section 179 deduction explained in chapter 8 under Depreciation for an asset and before the end of the assets. In other words the final years depreciation must be the difference between the NBV at the start of the final period here 2401 and the salvage value here 0. The question is figuring out which one provides the biggest tax advantage for your business.

1100 for more information. Advertising includes any money spent on marketing the company. Under GAAP its important that depreciation is charged in full so the total amount of depreciation for the computers needs to add up to 10000.

The process of figuring out how much an amount that you expect to receive in the future is worth today is called. Given that structures comprise the largest share of the capital stock improving the tax treatment of this asset class would likely have a large. If you are in the business of renting personal property equipment vehicles formal wear etc.

Equipment Depreciation Basics And Its Role In Asset Management

Depreciation Nonprofit Accounting Basics

Depreciation Rate Formula Examples How To Calculate

Computer Related Equipment Depreciation Calculation Depreciation Guru

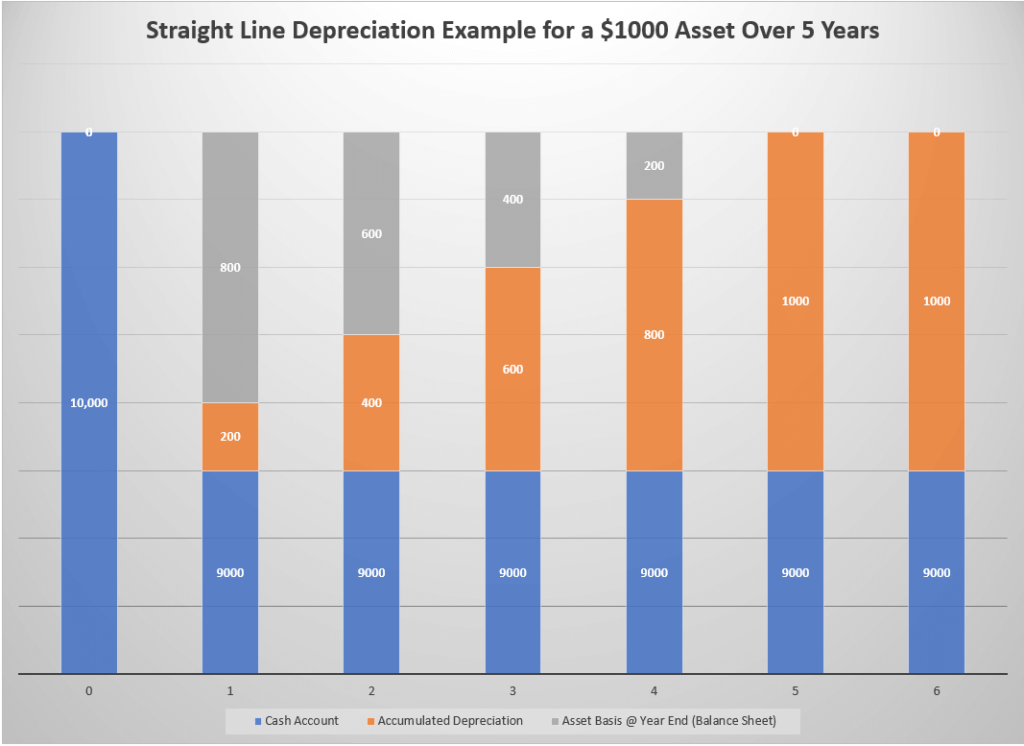

Accumulated Depreciation Explained Bench Accounting

What Is Equipment Depreciation And How To Calculate It

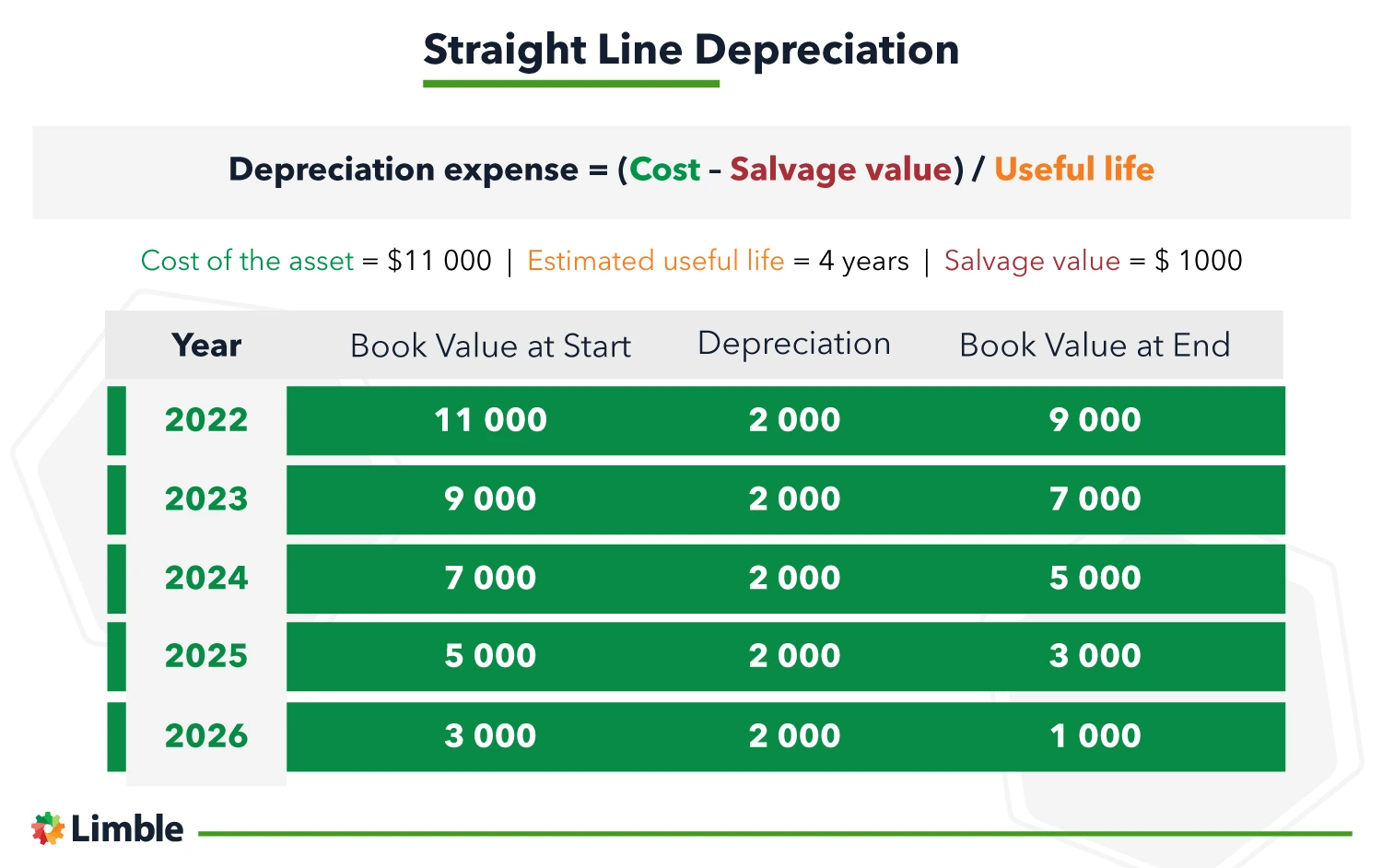

Depreciation On Equipment Definition Calculation Examples

Furniture Fixtures And Equipment Depreciation Calculation Depreciation Guru

Depreciation Nonprofit Accounting Basics

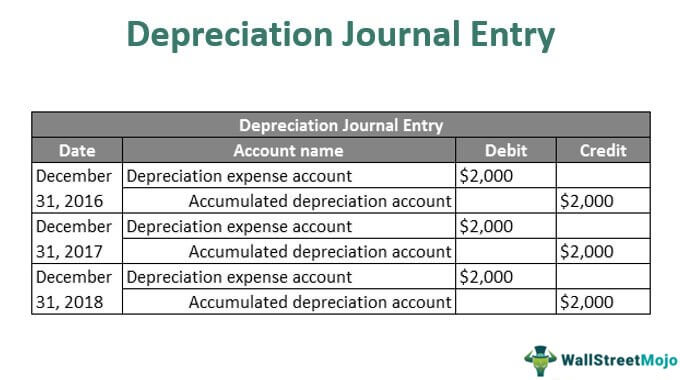

Depreciation Journal Entry Step By Step Examples

Equipment Depreciation Planning Engineer Est

Manufacturing Equipment Depreciation Calculation Depreciation Guru

Depreciation Formula Calculate Depreciation Expense

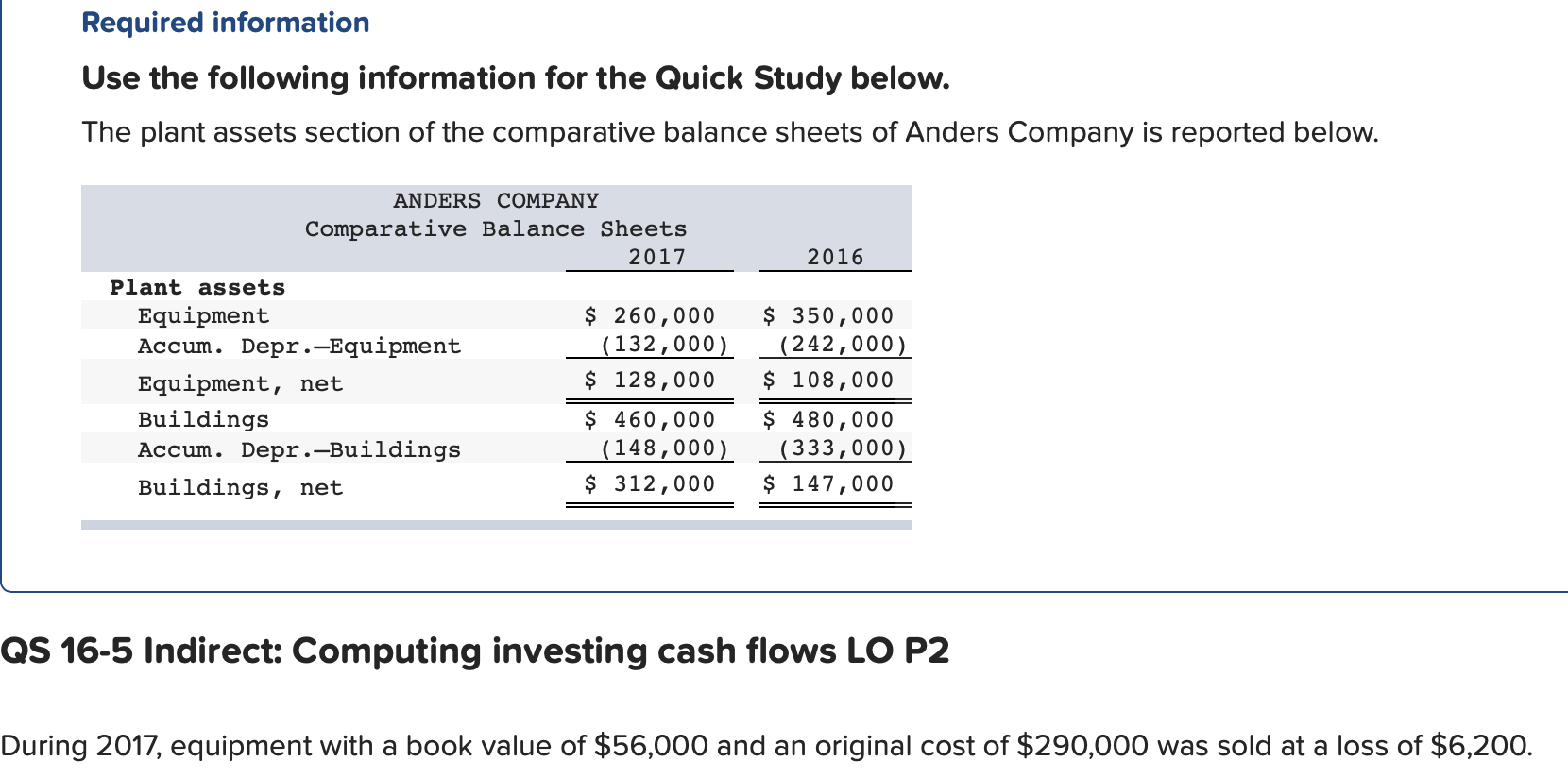

Solved How Do I Calculate The Depreciation Expense And Cost Chegg Com

Depreciation Formula Calculate Depreciation Expense

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition